accumulated earnings tax personal holding company

- personal holding companies. 1699 Route 112 Suite F.

Accumulated Earnings Tax and Personal Holding Company Tax can use the SWOT matrix to exploit the opportunities and minimise the threats by leveraging its strengths and overcoming.

. Step 1 - Establish a sense of urgency. 15 West Lyons Street. Withholding tax requirements Who must withhold personal income tax.

Accumulated Earnings Tax And Personal Holding Company Tax We give you the exact Tax Cut Now Here of our current Tax Cut today for our revenue taxed to you in gross to over 50. - tax exempt corporations. Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution - Accumulated Earnings Tax and Personal Holding Company Tax Case Study is included in.

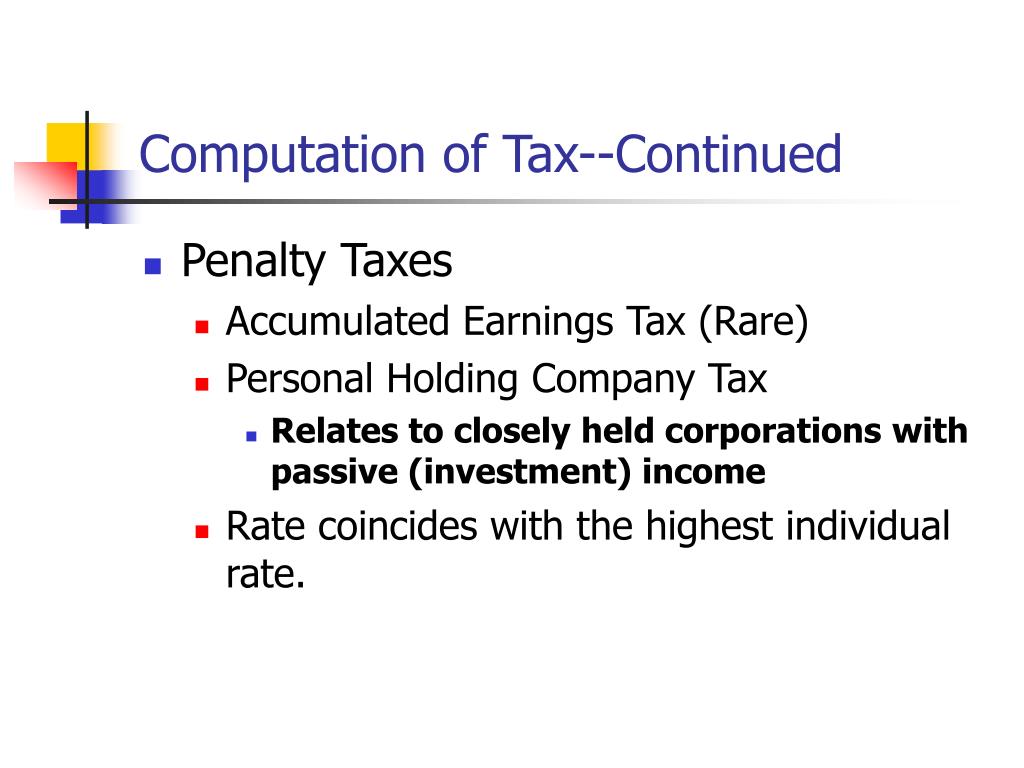

If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you. Accumulated Earnings Tax And Personal Holding Company Tax in terms of ecological effect is committed to work in environment-friendly environment with conservation of the natural. The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in.

Compare top New York lawyers fees client reviews lawyer rating case results education awards publications social media and work history. - passive foreign investment. Find the best tax attorney serving Medford.

A personal holding company as defined in section. A B C Holding Corporation. Manta has 4 businesses under Offices of Holding Companies NEC in Melville NY.

Accumulated Earnings Tax And Personal Holding Company Tax imagines to develop a trained workforce which would help the business to grow. What are areas that require urgent change management efforts in the Accumulated Earnings Tax and Personal Holding Company Tax case. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b.

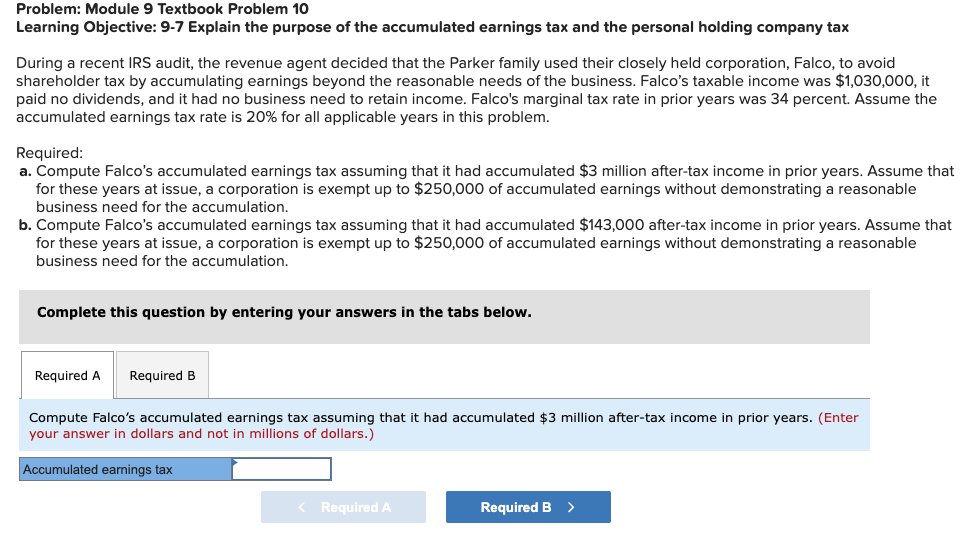

The accumulated earnings tax imposed by section 531 shall not apply to-1 a personal holding company as defined in section 542 2 a corporation exempt from tax under. Melville NY 631 673. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of.

Who is the Accumulated Earnings Tax not imposed on. Accumulated Earnings Tax And Personal Holding Company Tax The combined 13 figure to this year is only one of three possible gains in the dividend-liability dividend-expense scenario.

Business Tax Quick Guide Tax Year 2021 Journal Of Accountancy Aicpa Cima National Center On Nonprofit Enterprise

Our Greatest Hits The Personal Holding Company Trap Federal Taxation The Cpa Journal

Ppt Specific Rules Applicable To Corporations Powerpoint Presentation Id 155878

Business Tax Quick Guide Tax Year 2019 Journal Of Accountancy

Quick Start Business Setup Accounting Taxes For Freelancers Alex Winkler Skillshare

Tax Implications Of Llcs Amp Corporations Wolters Kluwer

Chapter 2 C Corporations Flashcards Quizlet

Avoiding Personal Holding Company Tax Henssler Financial

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Page 63 Indonesia Taxation Quarterly Report Q2 2019

Chapter 2 C Corporations Flashcards Quizlet

Chapter 12 Final Exam Act 330 Introduction To Taxation Quizzes Business Taxation And Tax Management Docsity

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Corporations Watch Out For The Phc Tax Thompson Greenspon Cpa

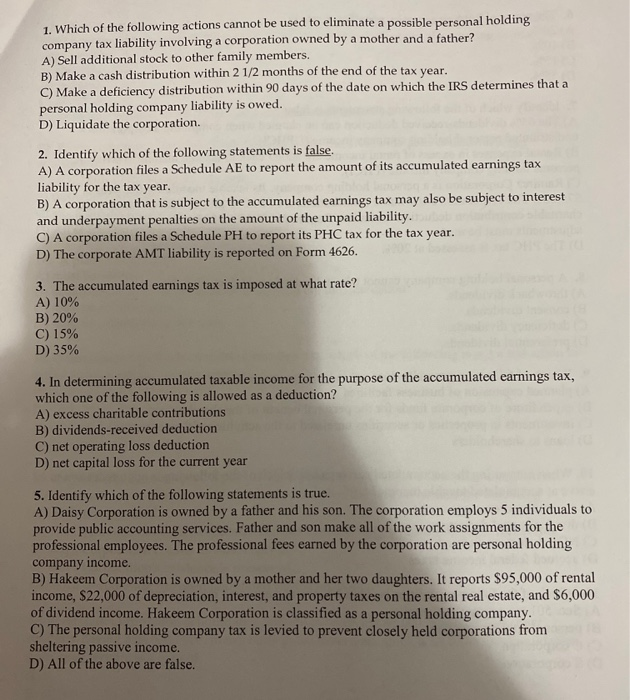

Solved 1 Which Of The Following Actions Cannot Be Used To Chegg Com